Compensation Report

Our goal is to be the employer of choice in our industry in order to retain and attract the best talent in the market. This is a prerequisite for also continuously creating sustainable value for our shareholders. The demand for qualified personnel on the labor market is very high in this respect and competition for talent has intensified further and must therefore remain in focus to support Tecan’s future growth globally.

As an attractive employer, we must offer competitive compensation with the right performance incentives. We have created an effective basis in recent years, but we want to continuously improve our compensation system. To this end, in the reporting year we also directly involved our employees. In digital focus groups evaluating our compensation concept, we received direct feedback from our employees on general compensation issues and potential additional benefits. We will now incorporate these insights into our continuous benchmarking.

However, a key factor in retaining and attracting the best talent is our corporate purpose: Scaling Healthcare Innovation to improve People’s Lives and Health. We are an important enabler for healthcare. Our contribution to scale testing for Sars-Cov-2 during the pandemic as well as our contributions to the fields of oncology, metabolic disorders, other infectious diseases and many more, illustrate our purpose statement tangibly to all colleagues working at Tecan. Being able to contribute to the well-being of others is important to many people. At Tecan, we make this possible. We also place a high value on our corporate culture, which is guided by the corporate values of trust, highest standards, and ambition, together with the leadership principles of courage, curiosity, and respect in combination with brutal honesty. In 2022, we again focused on developing our corporate culture and our leaders with various activities:

We introduced our new employer branding concept to create greater brand awareness in the labor market relevant to us and attract the best talent.

We invested in leadership development to enhance our leadership capabilities, and we continued to work on our Great Place to Work initiatives to continue the positive evolution of our work culture based on direct employee feedback.

The encouraging results of an internal pulse survey on the impact of our cultural activities confirmed that we are making continuous progress to be the employer of choice.

This Compensation Report describes Tecan's compensation principles and system. It provides information about the method of determining compensation and discloses the compensation awarded during 2022 to the members of the Board of Directors and the Management Board. It complies with the Ordinance against Excessive Compensation in Listed Stock Companies (OeEC), the standard relating to information on Corporate Governance of the SIX Swiss Exchange, and the principles of the Swiss Code of Best Practice for Corporate Governance of the Swiss national federation economiesuisse.

MESSAGE FROM THE CHAIR OF THE COMPENSATION COMMITTEE

Dr. Christa Kreuzburg

Chair of the Compensation Committee

DEAR SHAREHOLDERS

I am pleased to present Tecan's Compensation Report for the financial year 2022.

With this report, we would like to give you an insight into our compensation principles and our compensation system. With both, we aim to achieve our goal of being the employer of choice in our industry and to attract and retain the best talent. Our compensation system is designed to encourage excellence, combined with exemplary behavior in line with our values: trust, highest standards, and ambition. Our compensation principles and system are designed to reward outstanding performance in line with the interests of our shareholders.

In 2022, global macroeconomic challenges once again set the context. A higher inflation rate than experienced for decades, an unstable supply chain and material shortages made 2022 another exceptionally challenging year for Tecan and for the wider world. After 2020 and 2021, when Tecan focused on contributing to the fight against Covid-19, the company had to deal with these heightened aspects of uncertainty and complexity in 2022. The labor market also intensified due to a persistently high demand for talent. Tecan has therefore made targeted investments and defined global as well as local activities to invest in its existing workforce, and to gain better brand awareness among potential future employees. The goal is to increase Tecan´s visibility both within and outside of our direct industry to attract the best talent globally. I am proud that the team continues to successfully navigate through this challenging environment. In addition to managing the external spheres of influence, we have made significant progress in integrating Paramit Corporation, which we acquired in 2021. We invested significant time and resources to build bridges between the two companies, to learn from each other and create a common Tecan culture. The initiatives have been very productive, collaborative, open and transparent and have led to a shared understanding of who we are as Tecan, as well as a valuable understanding of how great the opportunities are for the newly formed group of companies and for the workforce.

This is now the third year of exceptional efforts due to Covid. "Working together" is our strength and drives the commitment and dedication of everyone at Tecan to improve people's lives and health. The pulse survey we conducted among our entire workforce in the fourth quarter of 2022 reassured us that we are in good shape and on the right track to continue guiding the commitment and passion of all our employees to meet our goal.

Despite the macro-economic challenges and a demanding labor market, we were able to grow our revenue organically by 2.2% in local currencies. As a result, we recorded an adjusted EBITDA margin of 20.1% of sales for Tecan (excl. integration and deferred benefits costs). This report explains how the company results drove the compensation awarded to members of the Management Board under the incentive plans.

We continued our path with a harmonized short-term incentive plan with a standard set of group-wide strategic targets for all our senior management. This incentive plan has proven to be a great vehicle to foster collaboration and to incentivize high performance across the entire company while creating a healthy and open work culture.

The Compensation Committee performed its regular activities during 2022. It included performance goal setting at the beginning of the year, the corresponding performance assessment of the Management Board at year end, the determination of the compensation for the members of the Management Board and for the Board of Directors, as well as the preparation of the Compensation Report and the “say-on-pay” vote for the Annual General Meeting of Shareholders (Annual General Meeting).

We are committed to sharing detailed information regarding the compensation system and the compensation awarded to the Board of Directors and the Management Board. Specifically, we provide details regarding:

- Governance: compensation decisions, including the role of shareholders, the Compensation Committee, and external advisors

- Compensation model of the Board of Directors: the split between the fixed basic fee and the committee fees

- Compensation model of the Management Board: a description of the incentive plan performance criteria, their weights, and a performance assessment at the end of the respective performance period

- Compensation table of the Management Board: including the compensation granted (and the compensation realized) in the reporting year

This Compensation Report will be submitted to an advisory vote at the upcoming Annual General Meeting. Shareholders will also be asked to vote on the maximum aggregate amount of compensation for the Board of Directors for the term of office from the 2023 Annual General Meeting until the 2024 Annual General Meeting, and on the maximum aggregate amount of compensation for the Management Board for the financial year 2024.

On behalf of the Board of Directors, I would like to thank you for your continued support. We hope that you find this report informative. We are confident that our compensation system rewards performance in a balanced and sustainable manner and is aligned with shareholders’ interests.

GOVERNANCE

ARTICLES OF INCORPORATION

As described in the Corporate Governance Report of this Annual Report, the Articles of Incorporation of Tecan include the following provisions on compensation:

- tasks and responsibilities of the Compensation Committee (Art. 17)

- compensation principles applicable to the Board of Directors and the Management Board (Art. 18 and 23)

- shareholders’ voting modalities on compensation motions at the Annual General Meeting, including the additional amount for members of the Management Board who were nominated after the shareholders’ approval of the maximum compensation amount (Art. 18)

- provisions around credits and loans to the Board of Directors and the Management Board (Art. 20)

- maximum permissible number of external mandates for members of the Board of Directors and the Management Board (Art. 21)

- provisions related to contractual agreements with members of the Management Board and the Board of Directors (Art. 22)

The full Articles of Incorporation are available on the corporate website: https://www.tecan.com/tecan-corporate-policies

ROLE OF SHAREHOLDERS ON COMPENSATION

The Ordinance against Excessive Compensation in Listed Companies took effect on January 1, 2014. The compensation and approval mechanism at Tecan was amended accordingly in 2015 and is set out in the Company’s Articles of Incorporation.

Each year, the Board of Directors proposes to the shareholders at the Annual General Meeting for their approval the maximum aggregate amount of compensation to the Board of Directors for the period until the next Annual General Meeting and to the Management Board for the following financial year. In addition, the Board of Directors presents the Compensation Report for a retrospective, advisory shareholder vote. The voting mechanism on the compensation motions is shown in illustration [1]. For further details on the compensation votes at the upcoming 2023 Annual General Meeting, please refer to the section “Outlook and Motions on Compensation at the Annual General Meeting”.

ILLUSTRATION [1]: COMPENSATION AND APPROVAL MECHANISM

COMPENSATION COMMITTEE

The Compensation Committee supports the Board of Directors and acts as preparatory body in all relevant compensation matters related to the Board of Directors and the Management Board. In accordance with the Articles of Incorporation and the Organizational Regulations of Tecan, the Compensation Committee is composed of at least two members of the Board of Directors who are elected individually by the Annual General Meeting for a period of one year. At the 2022 Annual General Meeting, the shareholders re-elected Dr. Christa Kreuzburg (Chair), Dr. Oliver Fetzer and Dr. Daniel Marshak as members of the Compensation Committee. Myra Eskes was elected to the Compensation Committee as a new and additional member.

The Compensation Committee meets as often as business requires. In the year under review, the Compensation Committee held four meetings in total, which all members attended. The CEO, CFO and Chief People Officer (CPO) may be invited to attend the meetings in an advisory capacity. Invited members of the Management Board do not take part in discussions on agenda items concerning their own performance or compensation. The Chair of the Compensation Committee reports to the Board of Directors regularly on the activities of the Committee. Minutes are kept of the meetings and are available to all members of the Board of Directors.

The Compensation Committee acts in a preparatory capacity and proposes motions to the Board of Directors for approval. The Board of Directors approves the compensation policies for the entire Group as well as the general conditions of employment for members of the Management Board. The Compensation Committee took the decision in 2021 due to high volatility in salary changes and due to Tecan’s growth strategy to benchmark every year the compensation of the Management Board. The compensation of the Board of Directors is more stable and will therefore be benchmarked from 2021 onwards only every three years. Both benchmarking exercises are executed with the help of independent external consultants. The Compensation Committee proposes and submits compensation amounts to the Board of Directors for approval. The Board of Directors reviews and approves the performance achievement of the members of the Management Board and the actual variable cash compensation to be paid out. The approval and authority levels of the different bodies on compensation matters are detailed in illustration [2] below.

ILLUSTRATION [2]: DECISION AUTHORITIES IN COMPENSATION MATTERS

| CEO | Compensation | Board of | Annual General Meeting |

Group compensation policy and principles |

| Proposes | Approves |

|

Maximum aggregate amount of compensation |

| Proposes | Reviews | Approves |

Individual compensation of members |

| Proposes | Approves |

|

Maximum aggregate amount of compensation |

| Proposes | Reviews | Approves |

Performance target setting and assessment |

| Proposes | Approves |

|

Performance target setting and assessment of other members of the Management Board | Proposes | Approves | Reviews |

|

CEO compensation |

| Proposes | Approves |

|

Individual compensation of other members | Proposes | Reviews | Approves |

|

Compensation report | Proposes | Reviews | Approves | Advisory vote |

BENCHMARKING SUPPORTED BY EXTERNAL CONSULTANTS

Tecan periodically reviews the total compensation for the members of the Management Board and Board of Directors, comparing data from executive compensation surveys and published benchmarks from companies of similar size in terms of market capitalization, revenue, number of employees, geographic reach, etc., and/or which are operating in related industries.

In 2022 an independent external consultant conducted a benchmarking analysis of the compensation of the Management Board. The consultant has no other engagements with Tecan. A demanding labor market, combined with an increased volatility in compensation in the target industry as well as Tecan’s growth trajectory, brought the Compensation Committee to the conclusion that from 2021 onwards, an annual benchmarking analysis should be conducted. As in the previous year, taking into account Tecan’s global footprint, the evaluation of the compensation levels and structure was compared to a transnational peer group: The peer group1 consists of listed companies only within life sciences and diagnostics, comprising similar companies found within Tecan’s operating markets in Europe and the US. It is focused and homogenous and allows for stability in the peer group in the coming years. At the time of the analysis, Tecan positioned in the lower half of the peer group on market capitalization and employee count and at the mid-point on revenue. This positioning allows Tecan to grow within the peer group as is currently anticipated. The EU/US peer group represented a 67%/33% split. Companies in the peer group operate in the same industry and target similar candidates and therefore compete with Tecan in the recruitment market. As a general outcome and compared to the peer group, the cash compensation paid to individual members of the Management Board was confirmed to be slightly below market practice. If the long-term incentive targets are significantly exceeded, (and only then), the total compensation may increase to levels above the market median. Consistent with earlier benchmarking exercises conducted in the past, the analysis showed that the compensation system at Tecan is more weighted towards the long-term incentive, while short-term compensation is positioned below market levels.

In 2022, consistent with the decision made in 2021, Tecan has not performed a benchmarking analysis of the structure and level of the Board compensation. Therefore, no proposal will be made to adjust the Board compensation for the upcoming period.

COMPENSATION PRINCIPLES

Tecan applies a set of uniform compensation policies, which are systematic, transparent and focused on the long-term perspective.

In line with good corporate governance, the compensation for the Board of Directors is fixed and does not contain any performance-based elements. This strengthens the Board’s independence in exercising its supervisory duties towards executive management. The fixed compensation is delivered in cash and in shares to strengthen the alignment with shareholders’ interests.

The compensation for the members of the Management Board is based on the following factors: financial performance of the Company, achievement of strategic goals including corporate sustainability goals, position within the Management Board and labor market situation. The ultimate goal of the compensation system is to attract and retain highly qualified and motivated talent, to ensure their long-term loyalty to the Company, incentivize performance and to align their interests with those of Tecan’s shareholders. The fixed and variable cash compensation programs are designed to cover the basic requirements, while the long-term incentive plan aligns total compensation with the long-term financial success of the Group and the value creation for shareholders of the Company. A clawback provision is in place, applicable to the initial equity grants under the Performance Share Matching Plan (PSMP) in case of termination on certain grounds.

- European Companies: Lonza Group AG, Mettler-Toledo International Inc, Eurofins Scientific SE, Smith & Nephew PLC, Carl Zeiss Meditec AG, Qiagen NV, GN Store Nord A/S, Evotec SE, Elekta AB, LivaNova PLC, Siegfried Holding AG, Bachem Holding AG; US Companies: PerkinElmer Inc, Bio-Techne Corp, Bruker Corp, Sotera Health Co, Neogenomics Inc, Medpace Holdings Inc

COMPENSATION SYSTEM OF THE BOARD OF DIRECTORS

There is no performance-based compensation for Board members and members of the Board of Directors are not insured in the Company pension plan. The fixed compensation consists of a fee for services paid in cash and in Restricted Share Units (RSUs), as well as additional committee fees paid in cash. The cash compensation is paid in two settlements in May and November, while the RSUs are allocated annually at the beginning of the term of office on the basis of the Tecan share’s average closing price on the SIX Swiss Exchange during the first four months of the relevant financial year. The RSUs fully vest and are converted into Tecan shares upon completion of the annual term, or pro rata in the event of an early exit.

The Compensation Committee does not see the necessity of proposing adjustments to the compensation levels at the upcoming Annual General Meeting. The compensation of the Board of Directors was approved by the Board of Directors, and at the 2022 Annual General Meeting, as described in illustration [3] below:

ILLUSTRATION [3]:

| Until 2022 Annual General Meeting | Since 2022 Annual General Meeting | ||||

In CHF per year (gross) | Chair of the Board | Vice-chair of the Board | Member of the Board | Chair of the Board | Vice-chair of the Board | Member of the Board |

Fixed basic fee (cash) | 200,000 | 90,000 | 80,000 | 200,000 | 90,000 | 80,000 |

Fixed basic fee (shares) | 100,000 | 55,000 | 45,000 | 100,000 | 55,000 | 45,000 |

| Until 2022 Annual General Meeting | Since 2022 Annual General Meeting | ||

| Committee Chair | Committee Member | Committee Chair | Committee Member |

Audit Committee | 30'000 | 10,000 | 30,000 | 10,000 |

Compensation Committee | 30'000 | 10,000 | 30,000 | 10,000 |

Nomination Committee | 30'000 | 10'000 | 30,000 | 10,000 |

In addition, members of the Board of Directors receive committee fees for ad-hoc committee meeting participation. They receive

reimbursement for business travel expenditures incurred, and a travel fee (for members located overseas only).

COMPENSATION SYSTEM OF THE MANAGEMENT BOARD

The compensation system for members of the Management Board (including the CEO) did not change compared to the previous year. It is defined in several regulations adopted by the Board of Directors and comprises:

- fixed base salary

- employee benefits, such as pension benefits, company car and expense allowance

- short-term variable cash compensation

- long-term equity incentive award, as a fixed monetary amount which is converted into shares and serves as initial grant for the Performance Share Matching Plan (PSMP)

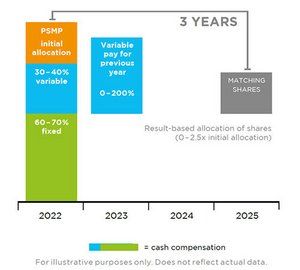

ILLUSTRATION [4]: COMPENSATION OF THE MANAGEMENT BOARD

| Vehicle | Purpose | Plan period | Performance measured |

Fixed base salary | Monthly salary in cash | Attract and retain | Continuous |

|

Benefits | Monthly benefits | Attract and retain | Continuous |

|

Short-term variable cash compensation | Annual bonus in cash | Reward annual performance | 1 year | Sales growth |

Long-term equity incentive award – PSMP | Grant of initial shares | Reward long-term performance Align with shareholders’ interests | 3 year | Sales growth |

STRUCTURE OF THE COMPENSATION SYSTEM

STRUCTURE OF THE COMPENSATION SYSTEM MANAGEMENT BOARD

For illustrative purposes only. Does not reflect actual data.

The compensation structure is based on a variable pay policy adopted by the Board of Directors, which provides for a total target cash compensation determined individually, consisting of a fixed base salary and a short-term variable cash compensation component. The total target cash compensation (assuming 100% target performance achievement under the short-term variable cash compensation) is weighted as follows:

- CEO: 60% fixed base salary and 40% short-term variable cash compensation

- other members of the Management Board: 70% fixed base salary and 30% short-term variable cash compensation

In addition, members of the Management Board are eligible to an annual grant under the long-term equity incentive plan (PSMP).

The compensation is subject to mandatory employer social security contributions (AHV/ALV). These contributions are paid by Tecan and are disclosed in the compensation report in compliance with Tecan’s reporting obligations.

FIXED BASE SALARY AND BENEFITS

The fixed base salary is a component of compensation paid in cash, typically monthly. It reflects the scope and key responsibilities of the role as well as the qualification and skills required to perform the role, along with the employee’s skill set and experience.

Fixed base salaries of the Management Board are reviewed annually, taking into consideration the benchmark information, market movement, economic environment, and individual performance.

In addition, the members of the Management Board participate in the pension and insurance plan of Tecan which is also offered to all employees in Switzerland. Benefits consist mainly of contributions to the retirement and insurance plan which is designed to provide a reasonable level of protection for employees and their dependents with respect to the risk of retirement, disability, death, and long-term illness. Members of the Management Board are also provided with a company car and are eligible to an expense allowance in line with the expense regulation, which is approved by the Swiss tax authorities.

The monetary value of that and other elements of compensation is evaluated at fair value and is included in the compensation table in illustration [8].

SHORT-TERM VARIABLE CASH COMPENSATION

The short-term variable cash compensation is an annual variable incentive designed to reward the performance of the Group over a time horizon of one year.

The short-term variable cash compensation target (i.e., at 100% target achievement of the performance objectives) is expressed as a proportion of the total target cash compensation, as explained above, i.e., 40% of the total target cash compensation for the CEO and 30% for the other members of the Management Board.

As mentioned in the message from the Chair of the Compensation Committee, in 2022 Tecan continued to offer all members of the Management Board a harmonized set of performance objectives. Hence, there are no individual performance goals in the short-term variable cash compensation, and it is solely based on Group financial performance objectives and corporate sustainability goals. The ambitious growth and profitability targets are set annually before the beginning of the financial year by the Board of Directors and assessed at the year end. For 2022, the financial performance indicators were the same as in previous years: sales growth and EBITDA margin of the Group. They are equally weighted and account for 80% of the short-term variable cash compensation. The corporate sustainability goals amount to 20% of the short-term variable cash compensation and are defined at Group level based on the strategic sustainability priorities of the Company. For 2022, they were related to social and governance aspects. For social aspects the focus was set on working culture improvements and customer satisfaction. For governance the focus was on responsible sourcing in the supply chain. For each performance objective, the Board of Directors determines a threshold level of performance below which the payout percentage is 0%, a target level of performance corresponding to a 100% payout and a maximum level of performance, above which the payout is capped at 200%. Payout levels between the threshold, the target and the maximum are calculated by linear interpolation.

In addition, the Articles of Incorporation stipulate that the short-term variable cash compensation may not exceed 150% of the fixed salary for the CEO and 100% for the other members of the Management Board.

The respective weightings of the performance objectives are included in illustration [5].

ILLUSTRATION [5]: PERFORMANCE OBJECTIVES FOR THE SHORT-TERM VARIABLE CASH COMPENSATION

|

|

|

2022 objectives | Rationale/driver | Weighting |

Sales growth (Group) | To drive the top-line growth of Tecan | 40% |

EBITDA margin (Group) | To drive the bottom-line profitability of Tecan | 40% |

Corporate sustainability goals | To drive strategic initiatives that foster the sustainability of Tecan in environment, social and corporate governance | 20% |

Total |

| 100% |

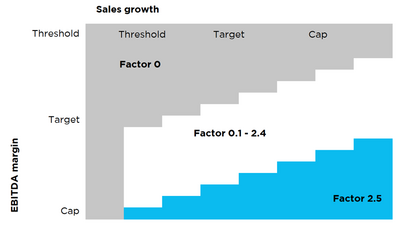

LONG-TERM EQUITY INCENTIVE AWARD – PERFORMANCE SHARE MACHTING PLAN (PSMP)

In addition to the cash compensation, the members of the Management Board participate in a long-term equity incentive award, the Performance Share Matching Plan (also referred to as executive restricted stock). The PSMP consists of an initial grant of registered shares and a potential subsequent allocation of matching shares based on the achievement of performance objectives during a three-year plan period.

The target amount of the initial grant is expressed as a fixed monetary amount, which is converted into shares based on the Tecan share’s average closing price on the SIX Swiss Exchange during the first four months of the relevant financial year. The shares allocated are blocked for three years – starting in the grant year as “year one”. For each granted share, members of the Management Board are eligible to receive additional shares (“matching shares”) at the end of the three-year measurement cycle if certain performance objectives are reached. This mechanism ensures that the interests of the Management Board are aligned with those of the shareholders, and it also ensures a permanent minimum level of share ownership of the CEO and of each member of the Management Board that is equivalent to the initial grants of three years.

Depending on the performance achievement during the three-year period, members of the Management Board may receive from 0 up to 2.5 matching shares for each share granted in year one. The performance is assessed using a payout matrix based on two performance criteria: sales growth in local currencies and EBITDA margin. The matrix combines the performance of each of the criteria to calculate the payout, thus providing for a balanced focus on both top-line and bottom-line achievements. Every year, Tecan’s Board of Directors reviews and approves a rolling five-year mid-term business plan presented by the Management Board, including targets for sales growth in local currencies and EBITDA margin. In the event that the mid-term targets are achieved for the three years covering a specific PSMP, an additional 1.25 matching shares for each initial share will be allocated to members of the Management Board. A payout factor of 2.5 would require an achievement significantly above the defined mid-term targets on the two performance criteria. An achievement level below a certain threshold on any of the criteria results in no additional matching shares. Different combinations of sales growth and EBITDA margin achievements within those ranges lead to payouts between a factor of 0 and a factor of 2.5. The parameter grid is specified each year on a forward-looking basis for the coming three-year period (i.e., financial objectives are pre-determined upfront).

In case of voluntary resignation (other than for retirement), the entitlement to any matching shares is forfeit. The initial shares granted are subject to a regular blocking period. In case of death, invalidity or change of control, the initially granted shares deblock immediately with an allocation of matching shares as soon as possible after such occurrence. In case of a termination for cause of the employment contract by the employer, any entitlement to matching shares is forfeited and any initial grants of each running cycle have to be returned by the employee.

ILLUSTRATION [6]: PERFORMANCE measures FOR THE PERFORMANCE MATCHING SHARES (EXAMPLES)

Performance measures |

| Sales growth | EBITDA |

Driver/rationale |

| To drive top-line growth of the company | To drive the bottom-line profitability of the company |

Weighting |

| Two-thirds | One-third |

Payout matrix (illustrative) |

|

| |

|

|

|

|

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 0.5) |

| Sales growth (CAGR) | EBITDA margin |

5.0% | 21.25% | ||

10.0% | 19.25% | ||

15.0% | 17.25% | ||

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 1.2) |

| Sales growth (CAGR) | EBITDA margin |

1.5% | 22.25% | ||

6.0% | 20.5% | ||

10.5% | 18.75% | ||

Payout matrix (actual examples of sales growth and EBITDA margin combination for a payout factor of 2.5) |

| Sales growth (CAGR) | EBITDA margin |

3.5% | 23.25% | ||

7.5% | 21.5% | ||

12.0% | 19.75% | ||

The above chart illustrates that the design of the PSMP is effective: in line with Tecan’s ambitious target-setting, substantial progress

needs to be made to reach the maximum payout factor of 2.5 upon expiry of the performance cycle.

EMPLOYMENT CONTRACTS

Members of the Management Board are employed under employment contracts of unlimited duration. The employment contract of the CEO is subject to a notice period of 12 months, while all other employment contracts of members of the Management Board are subject to a notice period of 6 months. Management Board members are not contractually entitled to any severance payments or any change of control provisions other than those under the PSMP termination provisions. Their contracts do not contain non-competition provisions.

CompENSATION TO THE BOARD OF DIRECTORS (AUDITED)

ILLUSTRATION [7]: Annual COMPENSATION TO THE BOARD OF DIRECTORS IN 2022 AND 2021

CHF 1,000 | Year | Fixed fee | Committee fee | Total cash compensation | Social benefits1 | Share award plan: shares granted (number)2 | Fair value of shares granted3 | Total |

Dr. Lukas Braunschweiler | 2022 | 200 | - | 200 | 16 | 256 | 75 | 291 |

2021 | 200 | 8 | 208 | 23 | 237 | 104 | 335 | |

Heinrich Fischer (Vice Chairman) | 2022 | 90 | 20 | 110 | 1 | 141 | 41 | 152 |

2021 | 90 | 26 | 116 | 4 | 130 | 57 | 177 | |

Dr. Oliver S. Fetzer | 2022 | 80 | 30 | 110 | - | 115 | 34 | 144 |

2021 | 80 | 33 | 113 | - | 107 | 47 | 160 | |

Myra Eskes | 2022 | 53 | 7 | 60 | 5 | 115 | 34 | 99 |

2021 | - | - | - | - | - | - | - | |

Lars Holmqvist | 2022 | - | - | - | - | - | - | - |

2021 | 27 | 3 | 30 | - | - | - | 30 | |

Dr. Karen Hübscher | 2022 | 80 | 40 | 120 | 12 | 115 | 34 | 166 |

2021 | 80 | 37 | 117 | 14 | 107 | 47 | 178 | |

Dr. Christa Kreuzburg | 2022 | 80 | 40 | 120 | 12 | 115 | 34 | 166 |

2021 | 80 | 42 | 122 | 14 | 107 | 47 | 183 | |

Dr. Daniel R. Marshak | 2022 | 80 | 20 | 100 | - | 115 | 34 | 134 |

2021 | 80 | 26 | 106 | - | 107 | 47 | 153 | |

|

|

|

|

|

|

|

|

|

Total | 2022 | 663 | 157 | 820 | 46 | 972 | 286 | 1,152 |

Total | 2021 | 637 | 175 | 812 | 55 | 795 | 349 | 1,216 |

- Employer’s contribution to social security

- Vesting condition: Graded vesting from May 1, 2021 to April 30, 2022 (Share Plan BoD 2021) and from May 1, 2022 to April 30, 2023 (Share Plan BoD 2022). Vested shares are transferred at the end of the service period (April 30, 2022 and April 30, 2023, respectively). The shares are fully included in the amount of fair value of shares granted

- Formula for 2021: Shares granted in 2021 * fair value at grant (CHF 437.60) and formula for 2022: Shares granted in 2022 * fair value at grant (CHF291.40)

At the 2021 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 1,300,000 for the Board of Directors for the compensation period from the 2021 Annual General Meeting until the 2022 Annual General Meeting. The actual compensation paid to the Board of Directors for 2022 was CHF 1,148,954.

At the 2022 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 1,450,000 for the Board of Directors for the term from the 2022 Annual General Meeting until the 2023 Annual General Meeting. This compensation period is not completed yet and a conclusive assessment will be provided in the 2023 Compensation Report.

COMPENSATION TO THE MANAGEMENT BOARD (AUDITED)

COMPENSATION AT GRANT VALUE

The illustration [8] shows the compensation of the CEO and the other members of the Management Board granted in the reporting year.

ILLUSTRATION [8]: GRANTED COMPENSATION

|

|

|

|

|

|

|

|

|

| Number of granted / awarded shares | ||

CHF 1,000 (gross amounts) | Year | Fixed Base Salary | Taxable fringe benefits | Social | Short-term variable compen-sation2 | Fair value of PSMP initial shares (in the year of grant)3 | Fair value of PSMP matching shares (in the year of grant)4 | Total compen-sation (granted) |

| PSMP: number of shares initial grant | PSMP: number of matching shares (at factor 1.25) | PSMP: number of matching shares (at maximum) |

Dr. Achim von Leoprechting5 (CEO, since April 1, 2019) | 2022 | 660 | 13 | 370 | 649 | 496 | 620 | 2,808 |

| 1,701 | 2,126 | 4,253 |

2021 | 660 | 12 | 351 | 858 | 560 | 700 | 3,141 |

| 1,280 | 1,600 | 3,200 | |

Tania Micki6 (CFO, since Feb. 17, 2020) | 2022 | 384 | 11 | 133 | 243 | 298 | 373 | 1,442 |

| 1,023 | 1,279 | 2,558 |

2021 | 363 | 9 | 132 | 304 | 353 | 441 | 1,602 |

| 806 | 1,008 | 2,015 | |

Other members of the Management Board7 | 2022 | 2,113 | 64 | 1,123 | 1,336 | 1,532 | 1,916 | 8,084 |

| 5,258 | 6,573 | 13,145 |

2021 | 2,048 | 58 | 1,162 | 1,714 | 2,085 | 2,606 | 9,673 |

| 4,765 | 5,957 | 11,913 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total | 2022 | 3,157 | 88 | 1,626 | 2,228 | 2,326 | 2,909 | 12,334 |

| 7,982 | 9,978 | 19,956 |

2021 | 3,071 | 79 | 1,645 | 2,876 | 2,998 | 3,747 | 14,416 |

| 6,851 | 8,565 | 17,128 | |

1 Employer's contribution to social security and contributions to post-employment benefit plans (including social security on shares transferred during the reporting period)

2 Payment will be made in the following year

3 Formula for 2021: Shares granted in 2021 * fair value at grant (CHF 437.60)

3 Formula for 2022: Shares granted in 2022 * fair value at grant (CHF 291.40)

4 Formula for 2021: Shares granted in 2021 * fair value at grant (CHF 437.60) * 1.25. The disclosed amount corresponds to the fair value of the matching shares at the time of grant (e.g. based on performance achievement at target). This value may differ from the value of the accruals disclosed under IFRS reporting, as those are based on a best-estimate at the end of the reporting year

4 Formula for 2022: Shares granted in 2022 * fair value at grant (CHF 291.40) * 1.25. The disclosed amount corresponds to the fair value of the matching shares at the time of grant (e.g. based on performance achievement at target). This value may differ from the value of the accruals disclosed under IFRS reporting, as those are based on a best-estimate at the end of the reporting year

5 Member of the Management Board with the highest compensation in 2021 and 2022

6 Member of the Management Board with the second highest compensation in 2021 and 2022

7 2021 and 2022: Total seven members

Explanatory comments on the compensation table:

- Details for the achievement of targets for short-term variable cash compensation in 2022 are given below.

At the 2021 Annual General Meeting, shareholders approved a maximum aggregate compensation amount of CHF 18,500,000 for the Management Board for the financial year 2022. The actual compensation awarded to the Management Board in 2022 was CHF 12,332,700 and is therefore within the approved limits.

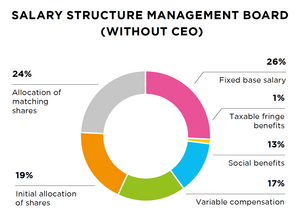

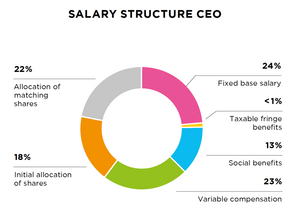

ILLUSTRATION [9]: COMPENSATION MIX

PERFORMANCE IN 2022

In the year under review, the Group sales growth and EBITDA margin, as well as the corporate sustainability objectives exceeded the pre-set targets. Tecan was able to navigate through complex and challenging external influences in an exceptional way.

Therefore, the performance assessment at year-end resulted in the following: the overall short-term variable cash compensation payout amounted to 147.5% of target for the CEO and all other members of the Management Board. In 2022, important ESG-related milestones were achieved regarding employee and company culture, customer satisfaction as well as a corporate governance target focused on responsible sourcing. The financial performance indicators used to calculate the payout amount were sales growth in local currencies and the EBITDA margin adjusted for acquisition costs. They were equally weighted and accounted for 80% of the short-term variable cash compensation. In 2022, both financial performance indicators were impacted by the contractual pass-through of higher material costs at the subsidiary Paramit. These pure pass-through effects increased reported sales growth but had a negative impact on the EBITDA margin as they do not include a profit margin. As no value was created by purely passing on the higher costs, Tecan excluded the net effect, which was not part of the original budget, from the calculation. Including the full pass-through effect, the payout for the CEO and all other members of the Executive Board would have been 157.7% of target.

In the year under review, the 2020 to 2022 PSMP cycle came to an end. The performance achievement over the performance period resulted in a matching share factor of 2.5. This reflects for the cycle 2020 to 2022 an average growth rate of 22.76% and an average EBITDA margin of 21.04%, therefore significantly outperforming the defined mid-term targets on the two performance criteria. For the year 2022, the impact of the contractual pass-through of higher material costs at the subsidiary Paramit has been treated as described above.

COMPENSATION TO FORMER MEMBERS OF GOVERNING BODIES

No compensation was paid to former members of the Board of Directors or the Management Board in 2022 after the end of their term of office or contract with Tecan, respectively. Former members of the Management Board received matching shares out of the PSMP 2019-2021 plan.

COMPENSATION TO RELATED PARTIES

No compensation was paid in 2022 or the previous year to parties related to present or former members of the Board of Directors or the Management Board.

LOANS AND CREDITS

CURRENT AND FORMER MEMBERS OF GOVERNING BODIES

Neither in 2022 nor in the previous year were any loans or credits extended to current or former members of the Board of Directors or the Management Board that remained outstanding at the end of the year.

RELATED PARTIES

Neither in 2022 nor in the previous year were any loans or credits extended to related parties of current or former members of the Board of Directors or the Management Board that remained outstanding at the end of the year.

SHAREHOLDINGS OF THE MEMBERS OF THE BOARD OF DIRECTORS AND THE MANAGEMENT BOARD IN 2022

Information regarding participations of the Board of Directors and Management Board in Tecan Group Ltd. can be found in the Notes to the financial statements of Tecan Group Ltd. (Note 13.2 on page 180 of this Annual Report).

OUTLOOK AND MOTIONS ON COMPENSATION AT THE ANNUAL GENERAL MEETING

At the 2023 Annual General Meeting, the Board of Directors will propose:

- the maximum aggregate compensation amount for the Board of Directors, for the next term of office (binding vote)

- the maximum aggregate compensation amount for the Management Board, for the financial year 2024 (binding vote)

- the 2022 Compensation Report (retrospective advisory vote)

MAXIMUM AGGREGATE COMPENSATION AMOUNT FOR THE BOARD OF DIRECTORS

The maximum aggregate compensation amount for the Board of Directors for the term of office between the 2023 and the 2024 Annual General Meeting submitted to vote is based on the following elements:

- seven members of the Board of Directors

- fixed basic fee paid in cash and Restricted Share Units

- committee fees paid in cash

- additional committee fees for ad-hoc committees and a travel fee (for members of the Board of Directors located overseas only)

MAXIMUM AGGREGATE COMPENSATION AMOUNT FOR THE MANAGEMENT BOARD

The maximum aggregate compensation amount to the Management Board for the financial year 2024 submitted to vote is based on the following elements:

- nine members of the Management Board

- short-term variable cash compensation: the maximum amount assumes that the defined performance objectives are significantly exceeded and that the short-term variable cash compensation payout amounts to 200% (maximum)

- long-term equity incentive award (PSMP): the maximum amount is based on a matching share factor of 2.5 (maximum). A possible share price appreciation during the three-year vesting period is not considered

Illustration [10] below shows a comparison between the maximum aggregate compensation amounts approved and the compensation effectively awarded in recent years.

ILLUSTRATION [10]: COMPENSATION APPROVED VERSUS AWARDED (MANAGEMENT BOARD)

In CHF per year (gross) | Fiscal year 20241 | Fiscal year 2023 | Fiscal year 2022 | Fiscal year 2021 |

Approved compensation amount | n.a. | 20,500,000 | 18,500,000 | 18,500,000 |

Compensation awarded | n.a. | n.a.2 | 12,332,700 | 14,416,000 |

- to be proposed to the 2023 Annual General Meeting

- compensation period not yet completed

Follow Tecan